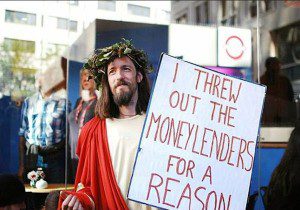

Citizens Dedicated To Preserving Our Constitutional Republic

The Trap of Debt Economics

24th October 2015

Guest Writer for Wake Up World

Money is a medium of exchange and the study of its use is called economics. In days gone by bartering was the order of the day. If you had corn and wanted wheat, and I had wheat and wanted corn, we would decide how much of one commodity was equivalent to the other and make an exchange on this basis. However, bartering is an awkward process because of the unwieldy items and commodities involved. Obviously, exchanges of goods would be facilitated if people used something less cumbersome as a medium of exchange such as gold or silver. If I grow wheat, by exchanging my wheat for gold it will allow me to obtain other things more conveniently when I want them. Thus metals like gold and silver became our first widely used mediums of exchange.

Once people started using gold and silver to trade goods, the need to transform these metals into standardized recognizable amounts became evident. This led to the development of rudimentary coins; whereby an authority would weigh out various quantities of these precious metals and stamp them as to purity and weight. Once this practice became common, it was only a matter of time before coins took on their characteristic disc shape and were impressed with a mint date and the likenesses of important officials. With the development of coinage, a person could exchange the fruits of their labor for coins and use them to obtain other things when convenient. During good times, some people ended up with more coins than they could use and this meant they needed a safe place to store them. This brought the goldsmith upon the scene!

Goldsmiths worked with precious metals and had safes or strongboxes within which they kept their supplies. Having this capability, it was only natural for people to take their excess coins to the goldsmith for safe keeping. Upon so doing, the goldsmith would give them a written receipt for the amount of coins being stored. Soon people realized that instead of trading coins for the things they needed, they could trade the receipts instead. Thus paper currency was born and this freed people from carrying bulky coins when they went to market.

This rudimentary monetary system worked well in small agrarian economies, but as villages turned into towns and towns into cities, a need to borrow money developed and who was better positioned to loan money than the goldsmith. Not only did he have his own money, but he also held other people’s money which was sitting in his coffers doing nothing. Of course, if the goldsmith was going to loan other people’s money, he needed to share some of the interest earned with them. This was the start of what we know of as modern banking. The goldsmiths were our first bankers. People would entrust their money to the banker/goldsmith and instead of paying him for this service, he would pay them a share of the interest he earned from loaning their money to other people. From the depositor’s and borrower’s perspective, this made sense and appears reasonable. However, appearances can be deceiving and how deceiving will soon become apparent.

If people were going to borrow money from a goldsmith, for obvious reasons it would be far more convenient if the loan was made in paper currency instead of coins. However, the demand notes presently in circulation were for all the coins held by the goldsmith. How could the goldsmith issue multiple demand notes on the same number of coins? The goldsmith knew that it was a rare occurrence when someone retrieved the coins they had on deposit. This being the case, if the goldsmith issued demand notes for more coins than he had, from a practical point of view, the chances were that he would always have sufficient money on hand to cover the notes that were redeemed by any one or even several of his depositors. Understanding this, our enterprising goldsmith went out on the limb and adopted this practice. Upon so doing, fractional banking was born.

he use of fractional banking by private bankers, although morally questionable, was a boon to society because it allowed and facilitated the loaning of money. This, as a matter of course, fueled development of our modern industrialized society. However, every blessing has a downside and as things are, the downside to private fractional banking is significant and far reaching. How terrible and far reaching it is, is a well-kept secret by the banking industry. As a result, very few people understand how fractional banking really works or how deplorable the downside to its use is.

When a person deposits gold with a goldsmith, he is given a demand note that can be traded as if it were the metal deposited. However, when the goldsmith issues a piece of paper to a borrower that can be traded in this same manner, the gold backing the note does not really exist. Instead of holding gold to back the currency being loaned, the goldsmith only has a promise from the borrower to not only deposit the gold being borrowed at some time in the future, but also, incredibly, to allow the goldsmith to keep this gold or silver as his own.

more at link below:

http://wakeup-world.com/2015/10/24/the-trap-of-debt-economics/?utm_...

Replies to This Discussion

-

- I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.

-

Military.comCongress early Friday sent President Barack Obama an ambitious budget and debt measure that averts a catastrophic national default and sets spending priorities for the next two years.

-

Fractional banking is the single most ingenious thing that advanced society to the level it is today, without this practice we would still be living with oudoor plumbing.

© 2025 Created by WTPUSA.

Powered by

![]()